Compulsory Convertible Debentures are a type of debt instrument that must be converted into equity shares at a specified time. These debentures offer investors the potential for a higher return through equity ownership.

What is compulsory convertible debentures? Compulsory Convertible Debentures, commonly known as CCDs, are a financial instrument issued by companies to raise capital. They function as a mix of debt and equity as they are initially issued as debt, but they have a mandatory conversion feature, which means they must be converted into equity shares at a pre-determined time.

This provides the investor with the potential for higher returns if the company’s equity value increases. CCDs are often utilized by companies as a strategic fundraising tool to inject capital into the business while also allowing investors to participate in potential future growth opportunities. Understanding the structure and implications of CCDs is crucial for investors and businesses considering this type of financing approach.

Features

Compulsory Convertible Debentures (CCDs) have distinct features that set them apart from regular debentures. The key feature lies in the conversion option, which gives the debenture holders the right to convert their debentures into equity shares at a predetermined ratio. These debentures also have a specific maturity period before conversion, during which they function as regular debentures. Additionally, the interest rate offered on CCDs may be higher than conventional debentures, making them an attractive investment option for both companies and investors alike.

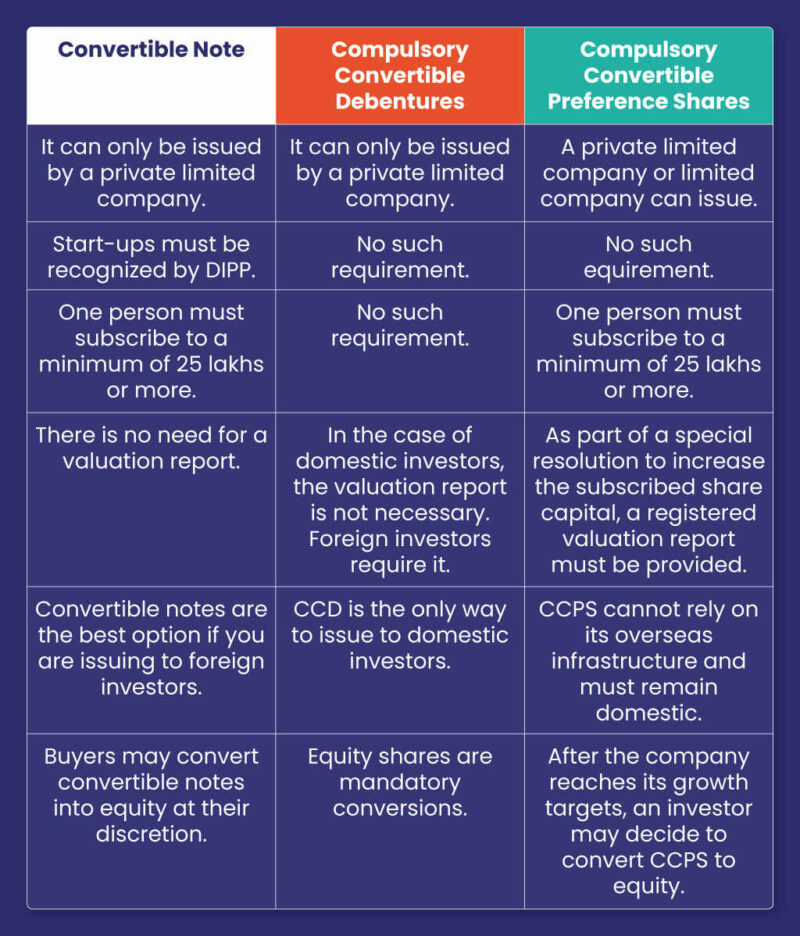

Credit: www.trica.co

Benefits

Compulsory Convertible Debentures (CCDs) offer investors the benefit of higher interest rates compared to traditional debentures.

For issuing companies, CCDs represent a source of raising funds and improving financial stability.

Risk Factors

Compulsory Convertible Debentures (CCDs) can come with certain risk factors that investors need to be aware of. One such risk is the dilution of ownership. CCDs have the potential to convert into equity shares of the issuing company at a later stage. This conversion can lead to an increase in the number of shares outstanding, thereby diluting the ownership percentage of existing shareholders. It is essential for investors to consider this potential dilution before making an investment decision.

Another risk factor associated with CCDs is the interest payment risk. CCDs often come with an interest coupon rate that needs to be paid periodically. If the issuing company faces financial difficulties and is unable to make these interest payments, it can lead to default. This default can affect the overall returns of the investment and pose a risk to the investors’ capital.

It is important for investors considering CCDs to carefully analyze the risk factors and assess their risk tolerance before investing.

Credit: www.trica.co

Regulatory Framework

Compulsory Convertible Debentures (CCDs) are governed by the regulatory framework set by SEBI, the market regulator in India. SEBI has issued specific guidelines for the issuance and trading of CCDs in order to protect the interests of investors.

Sebi Guidelines

SEBI guidelines require companies to obtain prior approval for the issuance of CCDs. These guidelines specify the terms and conditions for issuing CCDs, such as the conversion period, interest rate, and conversion price. SEBI also requires companies to disclose all material information related to CCDs to investors, ensuring transparency in the process.

Tax Implications

From a tax perspective, CCDs are treated as a debt instrument until conversion. Companies are liable to pay interest on CCDs, which is tax-deductible. However, once the debentures are converted into equity shares, they no longer attract interest, and tax implications shift accordingly.

Credit: tradesmartonline.in

Frequently Asked Questions On What Is Compulsory Convertible Debentures

What is Compulsory Convertible Debenture (ccds)?

Compulsory Convertible Debentures are a type of hybrid instrument which is initially issued as a debt and later converted into equity shares at a predetermined price. This gives the debenture holders the option to convert their investment into equity shares of the issuing company.

How Do Compulsory Convertible Debentures Work?

Compulsory Convertible Debentures work by allowing the investors to hold a debt instrument initially and then convert it into equity shares of the issuing company at a later stage. The conversion is typically triggered by specific events or a predefined timeline.

What Are The Advantages Of Investing In Compulsory Convertible Debentures?

Investing in Compulsory Convertible Debentures offers several advantages. It provides the potential for higher returns through equity conversion, while also providing the security of a debt instrument. Additionally, CCDs may offer preferential treatment in terms of dividends or voting rights.

Are Compulsory Convertible Debentures Risky?

Like any investment, Compulsory Convertible Debentures carry some level of risk. The risk level depends on various factors, including the financial health of the issuing company, market conditions, and the terms of the debentures. It is important to carefully evaluate these factors before investing in CCDs.

Conclusion

In essence, Compulsory Convertible Debentures offer a unique financing avenue for companies. Their blend of debt and equity features makes them a versatile choice for investors seeking potential growth and fixed returns. Understanding the intricacies of CCDs can empower businesses and investors to make informed financial decisions for the future.