Yes, business expenses can be carried forward if they are not fully utilized in the current tax year. Carrying forward business expenses allows for their deduction in future tax years.

This tax strategy can help businesses offset future profits and reduce taxable income. Businesses have the option to carry forward and deduct certain expenses that exceed their current year income. These expenses might include operating costs, marketing expenses, and business travel.

By carrying forward these expenses, businesses can effectively reduce their tax liability in the future. However, it’s essential for businesses to comply with tax regulations and guidelines when carrying forward expenses to ensure they are managing their finances effectively.

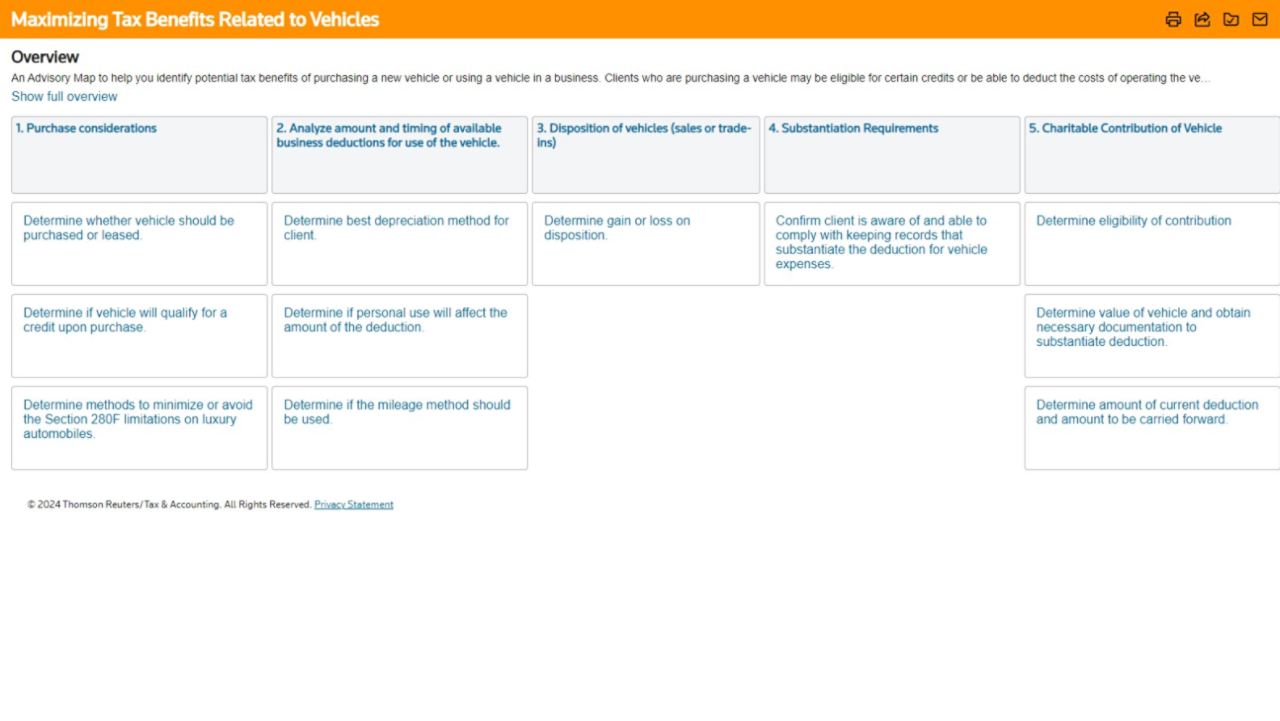

Credit: tax.thomsonreuters.com

The Basics Of Business Expenses

Business expenses can be carried forward to future years, providing an opportunity for businesses to offset their current year’s profit against future tax liabilities. This allows for greater flexibility in managing cash flow and minimizing tax obligations.

Business expenses are costs that a company incurs in conducting its operations. These expenses can be carried forward to the next tax year if they are not fully used in the current year. There are different types of business expenses, including operating expenses such as rent, utilities, and salaries, marketing and advertising expenses to promote the business, and travel and entertainment expenses for business-related trips and functions. It’s important for businesses to properly track and document their expenses to ensure they are accurately accounted for and can be carried forward as needed.

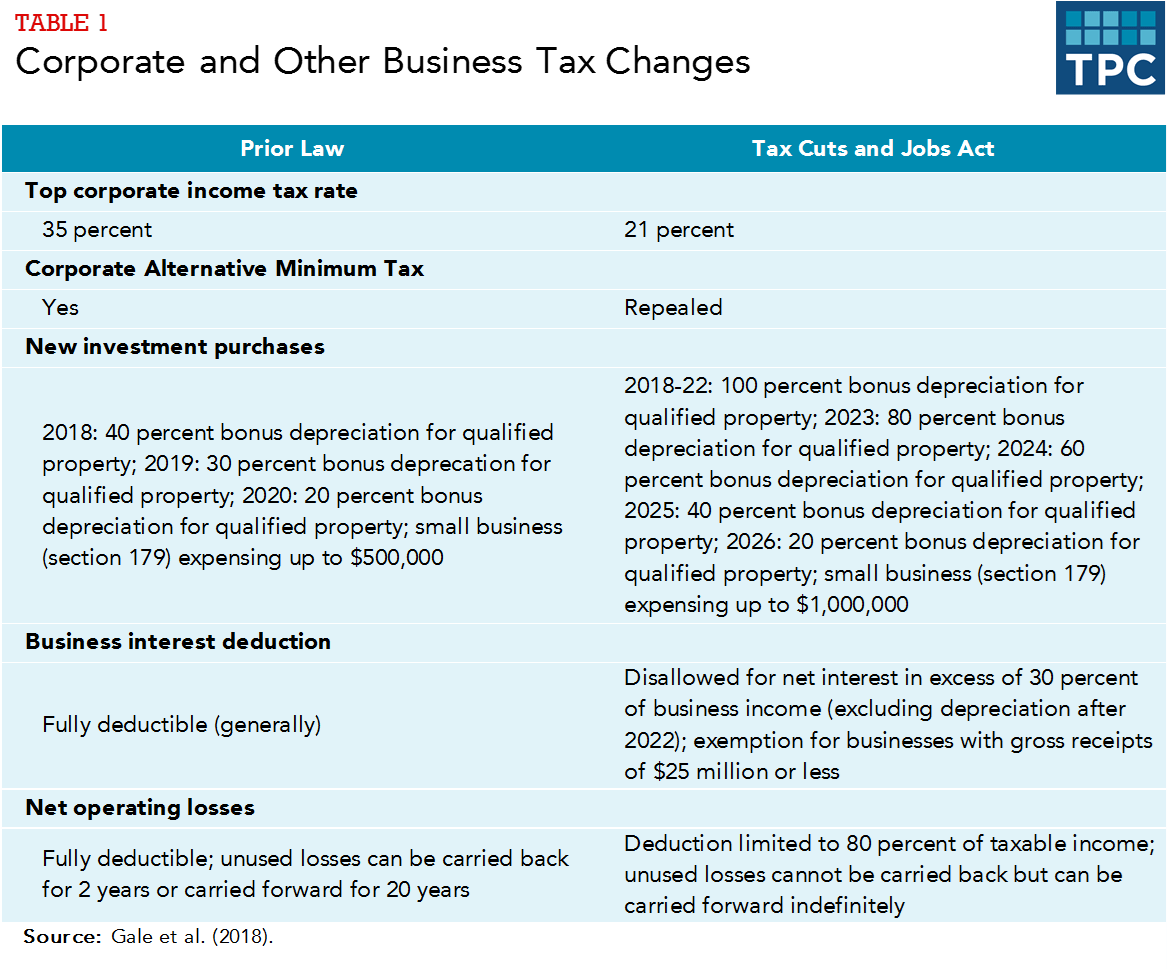

Credit: www.taxpolicycenter.org

Carrying Forward Business Expenses

Business expenses can often be carried forward to future tax years. This can be beneficial for businesses, allowing them to offset future profits and reduce their tax liability. By carrying forward expenses, businesses can take advantage of tax benefits and improve their financial flexibility.

| Business Expenses Carryforward: An Overview |

| Carrying Forward Business Expenses |

| Understanding carryforward of business expenses is crucial for financial planning. |

| Expenses can be carried forward to offset future income tax liabilities. |

| Limitations and restrictions may apply to the amount and duration of carryforward. |

| Consult a tax professional to optimize your business expense carryforward strategy. |

Tax Benefits And Strategies

Optimizing tax benefits and strategies is crucial for businesses. When considering business expenses, it’s important to understand the rules regarding carrying them forward. By planning strategically, companies can maximize their tax advantages while ensuring compliance with regulations and optimizing financial efficiency.

Maximizing tax savings through business expenses is a key consideration for many businesses. One effective strategy is to utilize carryforwards effectively, which allows businesses to carry forward unused tax deductions or credits to future years.

This can provide significant tax advantages, as businesses can offset future profits with previously unused deductions or credits. For example, if a business incurs substantial expenses in one year but has minimal profit, they can carry forward those deductions to reduce their taxable income in future years when profits are higher.

It is important for businesses to thoroughly document and keep track of all expenses throughout the year to ensure eligibility for carryforwards. Additionally, understanding the specific rules and limitations related to carryforwards is crucial to maximize tax savings.

By effectively utilizing carryforwards, businesses can strategically manage their expenses and maximize their tax savings. This proactive approach to tax planning can ultimately contribute to the overall financial success of the business.

Record-keeping And Documentation

Proper documentation is crucial for recording and keeping track of business expenses. Effective record-keeping allows businesses to maintain accurate financial records, which are essential for tax purposes and compliance with regulatory requirements. By maintaining organized and detailed records, businesses can easily identify deductible expenses and substantiate them during an audit. It is important to keep copies of invoices, receipts, and bills to provide evidence of business expenses.

There are several strategies for effective record-keeping, including using accounting software or cloud-based platforms to digitize and store documents. Creating a standardized filing system and labeling folders and files can help in locating specific records quickly. Additionally, regularly reconciling bank and credit card statements with the recorded expenses ensures accuracy. Backing up data regularly is crucial to prevent the loss of important financial information.

By implementing effective record-keeping strategies and maintaining proper documentation, businesses can ensure the smooth handling of expenses, accurate financial reporting, and compliance with legal and regulatory requirements.

Risk Of Audit And Compliance

Business expenses can be carried forward for future tax years.

It is important to adhere to compliance measures when carrying forward expenses.

To reduce the risk of audits, proper documentation is critical.

Keep accurate records and ensure all expenses are legitimate.

Review tax laws regularly to stay updated on regulations.

Expert Advice And Resources

Gain insights on carrying forward business expenses with expert advice and comprehensive resources. Maximize tax benefits and optimize your financial strategies effortlessly. Access valuable tips to effectively manage your expenses for long-term success.

The question of whether business expenses can be carried forward is a common one for many business owners. Seeking professional guidance is always recommended to ensure accurate and up-to-date information. Fortunately, there are valuable resources available for business owners to help navigate this process.

One helpful resource is the IRS website, where you can find clear guidelines and information on carrying forward business expenses. Another valuable resource is consulting with a qualified accountant or tax professional who specializes in business taxes. They can provide expert advice and personalized guidance based on your specific financial situation and business needs.

Furthermore, networking with other business owners and joining industry-specific associations can provide access to valuable insights and experiences regarding carrying forward business expenses. Remember, staying informed and seeking professional guidance are key to navigating the complexities of business taxes and ensuring compliance with regulations.

Case Studies And Examples

Carrying forward business expenses can be a useful strategy for businesses to optimize their tax liabilities. In real-life scenarios, companies facing losses in a particular year can utilize carried forward expenses against future profits. For example, a technology startup in its initial years may have substantial research and development costs that exceed its revenue. By carrying forward these expenses, the startup can offset future taxable income, reducing its tax burden. Similarly, businesses with seasonal fluctuations or cyclical sales patterns may benefit from carrying forward expenses to smooth out their tax liabilities across multiple years. These case studies showcase how businesses can strategically manage their expenses for long-term financial optimization.

Conclusion And Action Plan

After analyzing business expenses…

Viewport solcitudin venenatis. Implementing strategies maximizes tax benefits for businesses.

Businesses must plan strategically…

:max_bytes(150000):strip_icc()/tax-loss-carryforward.asp-Final-b28809370a574b75ab8b3f17621f3287.png)

Credit: www.investopedia.com

Frequently Asked Questions Of Can Business Expenses Be Carried Forward

Are Business Expenses Tax Deductible?

Yes, legitimate business expenses are tax deductible according to the IRS guidelines. Keeping detailed records is crucial to support deductions.

Can Business Expenses Be Carried Forward?

In certain circumstances, business expenses can be carried forward to offset future income. It helps in reducing tax liabilities over time.

What Are Common Deductible Business Expenses?

Common deductible business expenses include office supplies, travel costs, rent, utilities, and professional fees. Keeping accurate records is essential for deductions.

How Do Business Expenses Affect Profitability?

Monitoring and controlling business expenses directly impact profitability. Managing costs effectively can lead to higher revenues and increased profitability. It is essential to track all expenses.

Conclusion

To sum up, carrying forward business expenses can provide tax benefits for future years. Knowing the rules and regulations around this practice is crucial for maximizing your deductions. Stay informed and consult with a financial advisor to make the most of these opportunities.

Maximize your tax savings wisely.